J&K Government tabled the J&K Economic Survey 2017 in the state legislature. It carries a number of chapters listing and detailing the various initiatives that were introduced last fiscal. One of them is about the how the government is working on Public Financial Management System. Here Kashmir Life reproduces the entire chapter in larger public interest to explain what it is all about and how will it operate

In a bid to have paperless budget, Government of Jammu and Kashmir has introduced Budget Estimation Allocation Monitoring System (BEAMS) with the objective of facilitating easy co-ordination among the Drawing and Disbursing Officer, Head of Departments, respective Departments, Finance Department and State Treasuries/PAO offices through Electronic Platform. This system owes its origin from one of the core infrastructure components introduced by the Government of India under National e-governance Plan (NeGP) to support budgeting process more efficiently, improve cash flow management, promote real time reconciliation of accounts, and strengthening management information systems. Improved accuracy and timelines in preparation of accounts, bring transparency and efficiency in public delivery systems and for better financial management along with improved quality of governance in the State.

In a bid to have paperless budget, Government of Jammu and Kashmir has introduced Budget Estimation Allocation Monitoring System (BEAMS) with the objective of facilitating easy co-ordination among the Drawing and Disbursing Officer, Head of Departments, respective Departments, Finance Department and State Treasuries/PAO offices through Electronic Platform. This system owes its origin from one of the core infrastructure components introduced by the Government of India under National e-governance Plan (NeGP) to support budgeting process more efficiently, improve cash flow management, promote real time reconciliation of accounts, and strengthening management information systems. Improved accuracy and timelines in preparation of accounts, bring transparency and efficiency in public delivery systems and for better financial management along with improved quality of governance in the State.

The BEAMS is an online computerized system to distribute the budget and to authorize expenditure. As soon as the budget is released, the Administrative Departments can allocate funds to their Controlling Officers / Drawing and Disbursing Officers through this system. All the expenditure is thereafter not only checked for budget availability before the bills can be submitted, but also the monthly cash flows are controlled against pre-determined targets.

This system permits the withdrawal/surrender of budget grants. The system provides limited facility to modify cash flows. Management Information System (MIS) within the reporting module gives various reports on budget authorizations, cash flows, fund transfer transactions and authorization slips generation.

Scope of BEAMS

BEAMS application has a wide scope in comparison to the manual budgeting process which lacks transparency and is construed with difficulties due to time delay in authorizations, ineffective monitoring and budget control mechanism. The new system offers greater flexibility of inputs and in return process for greater emphasis on outputs and performance. The BEAMS application enables to view budget allocation instantly without any time delay just at the click of the button. The flow of information is very reliable, accurate and fast enabling better monitoring, control and sustainable decision support system for better planning and expenditure audit. The BEAMS has inbuilt tools enabling internal budget control and external interface in following manner:

Internal Monitoring and Budget control tools

Following are the functional tools available within the application which augment internal control mechanism

- Budget Estimation

- Budget Allocation

- Withdrawals and Re-allocation

- Excess/Surrender

- Re-appropriations

- Budget Control Register

- Monitoring of the CSS and other resources

- Budget Release order, Discussion Sheets

External Interface Support System

BEAMS enable following external interface mechanisms

- Integration with Treasury/PAO system

- Interface between functional DDO and Payment system

- Reporting and expenditure reconciliation system with AG/Accounting authority

Objectives of BEAMS

Objectives of the BEAMS application can be summed up as under:

- To automate the workflow process of Budget Estimation and Budget Allocation functioning and carry out the processes, defined in a systematic manner.

- To enable exchange of Data between BEAMS and TreasuryNet.

- To generate data for Budget Expenditure monitoring.

- To provide interface for exchange of information with AG/accounting authority.

- To keep the checks and balances on diversion / blockage of funds.

- To monitor the Centrally Sponsored Schemes (CSS) and the generation of utilization certificates.

Budgeting Structure levels

There are various levels of Budget Estimation and Data exchange. The information flows from one level to another in a bidirectional manner. Each level is defined as under:

Drawing and Disbursing (DDO) level

DDO is the basic expenditure incurring level in the overall budget allocation, monitoring and control system. BEAMS application enables each DDO to frame online Budget Estimates which are approved by the budget controlling officer (BCO) and information flow in upward direction as well as downward direction.

Budget Controlling Officer (BCO) Level

At this level the Budget is scrutinized which is furnished by each DDO under the jurisdiction of one BCO and the scrutinized Budget after made necessary changes if any are forwarded online by the BCO to the next higher authority which is the Budget Controlling Authority (BCA), most probably Head of the Department.

Budget Controlling Authority (BCA)

At the level of BCA the Budget of the Department is prepared which comprises of, the budget furnished by each subordinate BCO and the corrections made at each subordinate levels are scrutinized at the level of BCA and the whole Budget Estimates of the Department are furnished by the BCA in the application to the next higher authority which is the Administrative Department (FDA) and ultimately it is the FDA which formulate budget of the whole Department at the State level.

Finance Department (FD)

The Budget formulated by the BCAs at the State Level is consolidated thereafter at the Finance Department in tandem with the availability of the resources. The FD level in the application has access to the whole budget of the State and Management Information System (MIS) is developed in the application at FD level. The flow of Information from FD level to down the DDO levels is bidirectional.

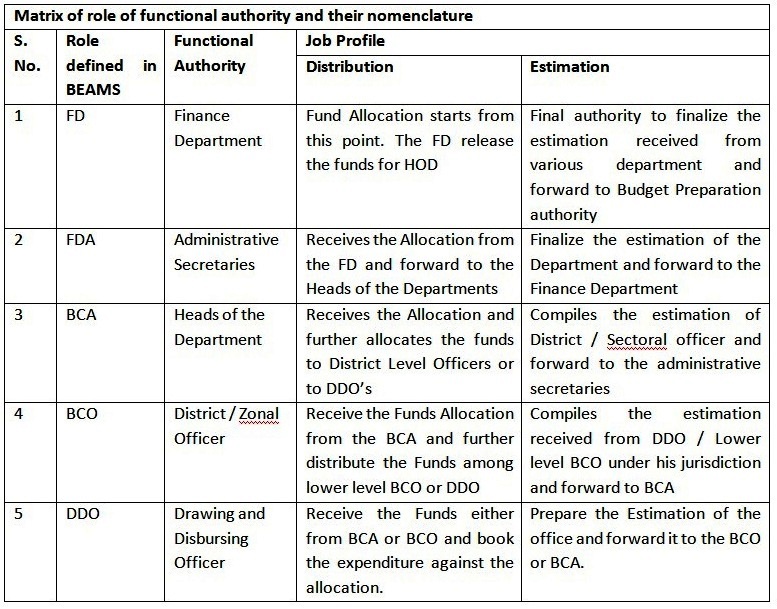

The matrix below shows the role of each Functional authority and their nomenclature in the BEAMS Software Application.

The Budget formulation involves from the actual base unit of expenditure incurring authority to the highest level which authorizes the expenditure that is Legislature of the State. The structural module of BEAMS is shown diagrammatically a under:

The Budget formulation involves from the actual base unit of expenditure incurring authority to the highest level which authorizes the expenditure that is Legislature of the State. The structural module of BEAMS is shown diagrammatically a under:

BEAMS Modules

The descriptions of various modules of BEAMS application are given as under:

Estimation Module

Under this module, budget estimates in the prescribed formats are formulated. The estimation module involves two modes of processing systems, one is the estimate formulation by the maker system and another is the scrutinisation/checking of the estimates by the checker system. The two processes in the Budget Estimation Module are:

- a) Budget Estimation Proposals / Compilation

- b) Budget Estimation Approvals

Allocation Module

The budget formulated in the Estimation Module after proper approval is allocated to various Departments through this module. All the levels from the FD to DDO level is involved in the Budget allocation part. The various processes involved in this module involve:

- a) Budget Allocation

- b) Additional Allocation

- c) Common Scheme Allocation

- d) Resources Allocation

Expenditure Module

Under this module expenditure can be monitored on real time basis directly from treasury system. The expenditure progress can be monitored on monthly basis under all the head of accounts from detailed head to the major head of account department-wise. This is an important tool for top management level for ensuring better fund utilization management and liquidity management.

The processes involved in this module include;

- a) Bill Entry

- b) Authorization Slip Generation

- c) Treasury Interface

Budget Cut Module

This module of BEAMS gives position of anticipated excess/ surrender position so that appropriate decision is taken whether to withdraw funds or re-allocate under different head of account. This module involve following three processes:

- a) Withdrawal

- b) Surrender

- c) Re-allocation/re-appropriation

Reporting Module

BEAMS application enables to generate various statements which are vital from the management’s perspective and facilitates building a constructive Management Information System which could be explored for effective performance appraisal and valuable for implementation of zero-based Budgeting and performance based Budgeting system. The reporting module of the BEAMS application generate following reports relevant for effective governance and upto date information which can be utilized for calculation of various developmental indices. These reports are as under :–

- a) Budget Release Orders

- b) Budget Allocation and Expenditure Reports

- c) DDO Budget Register

- d) Discussion Sheets

- e) Resources Funds Position

- f) Re-appropriation Orders

Interfacing Module

The BEAMS application can be interfaced with other systems to take mutual benefits of each sub-system in the overall Integrated Financial Management System. The BEAMS application can be integrated with the Public Financial Management System (PFMS) application to obtain information of each Centrally Sponsored Scheme and its corresponding State Share to be adopted for distribution through BEAMS. The BEAMS has to be integrated with the Treasury/PAO system to ensure adherence to proper accounting standards under relevant heads of accounts as per the allocations made by the Finance Department. The expenditure shall be booked in the Treasury/PAO only under the proper classification which shall be easily accessed from the BEAMS application. The BEAMS application shall in due course be also integrated with the Pay-Sys/DDO application to get the exact estimates from the DDOs including Salary Budget as well. Following are the three systems with which BEAMS integration is under progress and shall be a major step forward to develop an efficient and effective Integrated Financial Management System in the State for better public delivery and governance system.

- a) Public Financial Management System (PFMS)

- b) Treasury/PAO System

- c) Pay-Sys/DDO Application.

Conclusion

As soon as the budget session concluded during last financial year, funds to each department under revenue component were released through BEAMS. The departments further allocated funds through this route only. In furtherance to it budget estimates for the next financial year 2018-19 and revised estimates for the current financial year 2017-18 were also received online using BEAMS application. No hard copies of budget proposals were received in Finance Department. All the proposals were received online through BEAMS. The Jammu &Kashmir State has joined elite group of only few States in India who have transitioned from documentary budgeting to paperless budgeting process. Way forward in this aspect shall be to capture capital budgeting process also within the ambit of BEAMS and monitoring of expenditure upto the lowest level of expenditure incurring authority which is upto the level of the Drawing and Disbursing Officers (DDOs).

The path breaking initiative shall facilitate the Government to set into motion the developmental process in a time bound manner and will be a windfall to vindicate system inefficiencies and shall ensure better cash management, allocation, accounting and effective monitoring at all the levels to enforce better public finance management policy for the betterment of the people of the State.