Revamping Kashmir Economy

Dr Mubeen Shah

Kashmir Chamber of Commerce & Industry (KCCI) wants the 13th Finance Commission to make necessary recommendations that would guarantee the people of...

Station downtown

Located at the centre of the town, Iqbal Mini Hydel Project is the main source of electricity in Kargil district. Prior to Iqbal the...

Annual Plan 2012-13

The Planning Commission of India has yet to formally determine the size of the Twelfth Five Year Plan, which, when finalized, will also give us a firm idea about the likely size of our successive annual plans for the coming five years.

Reviving A Symbol

For the youngsters, the Mall powerhouse at Bhaderwah might be just a few years old. But the fact is that implementation of this project...

Budget Estimates 2012-13

The next year’s total receipts and expenditure are estimated at Rs 33,853 crore each. The total revenue receipts are estimated at Rs 29,948 crore...

Upper Sindh-I: Completely Indigenous

The indigenously built power station has never stopped working with returns of several times the investment made in constructing the project, making some to...

2011-12: The Revised Estimates

The total budgetary receipts are placed at Rs 31,022 crore in the Revised Estimates in comparison to the Budget Estimates of Rs 31,212 crore. The total receipts consist of Rs 25,513 crore as revenue receipts and Rs 5,509 crore as capital receipts.

Lighting up LoC

The 2-MW power project at Karnah has run into rough weathers at least twice, now the PDC is up-rating it to 12-MW generation, finds...

Empowering Jammu and Kashmir

Eight reporters and lensmen travelled more than 5,000 km across remote belts in Ladakh, Kashmir and Jammu for 15 days to cover 24 powerhouses....

10 Critical Concerns

Preparation of budgetary proposals is always a difficult and thorny task. However, I will be missing an important aspect of my duty if I...

Budget 2014 -15

With the fiscal deficit under control and the overall growth rate better than the national average, J&K is anticipating to spend a record Rs...

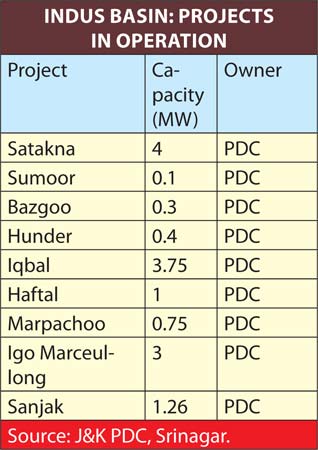

The Resource

The Indus Water Treaty has given Islamabad rights over three J&K rivers – Chenab, Indus and Jhelum with an average flow of 135 million...

IWT: Let The Treaty Survive, Updated

Amid demands of its abrogation and claims of massive losses to the state economy, J&K government has appointed a consultant to quantify the impact...

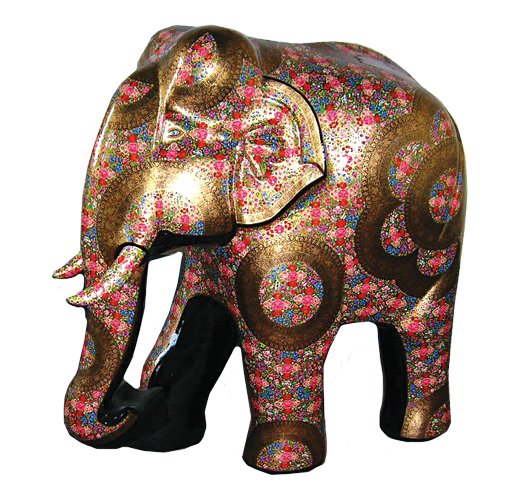

Weaving Magic

A special thread from Assam mounted onto the handloom along with thickened silk from Patna, the skillful hands of a Kashmiri artisan and the...

The Mohra Marvel

Horse-carts drove the American turbines as the Afghan, Balti, and Punjabi labour force working under British engineers fought intermittent cholera attacks to create India’s...