Taxing Times

The pellet-powered government was so shocked by the reaction to new tax regime that it is unable to tell people that it wanted to...

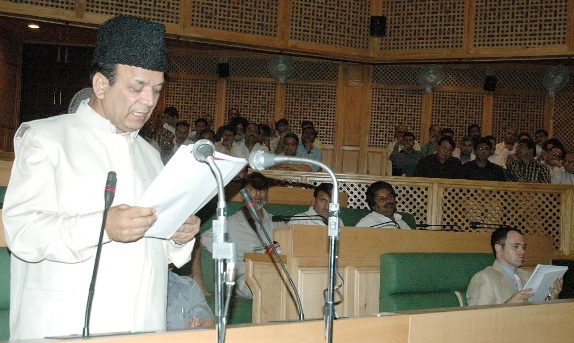

A Privileged FM

I am, indeed, privileged to rise before this august House, to present in succession, the third annual budget of the coalition government headed by...

Budget 2021-22: The Speech

Finance Minister Nirmala Sitharaman presented the Jammu and Kashmir budget proposals for 2021-22 to the Lok Sabha on March 17, 2021. This was her...

Drabu Direction

Economist Haseeb Drabu’s maiden budget as Finance Minister is being projected as the new Bible of the PDP-BJP coalition. Given the rudimentary shifts effected,...

The Rs 40,000 Crore Meeting

For three days, last week, a series of close door interactions took place around Zabarwan Hills in Srinagar as the 13th Finance Commission team...

Budget 2011-12: Budget In Classroom

Revenue Receipts : are all those receipts, which do not incur repayment liability. These include, in addition to the State’s own revenues (Tax and...

#Budget2017-18: FinMin Dr Drabu’s Complete Budget Speech

Dr Haseeb A Drabu Wednesday presented third budget as Minister of Finance in the PDP-BJP government. Kashmir Life reproduces full budget speech in larger...

JK Budget 2023-24

Nirmala Sitharaman’s fourth consecutive budget has reduced funds for developmental activities as expenditure booked for asset creation in 2022-23 saw a steep fall, reports Raashid...

Economic Scenario

I have already laid the economic survey report on the table of the House. Hon’ble Members may have noted that GSDP of the State...

Fiscal Initiatives

VAT on food grains

I had apprised the Hon’ble Members last year that several states are charging VAT at rates, ranging from 4% to 5%, on atta, maida, suji, besan, paddy and rice etc. In consideration of last year’s rising food inflation as an All India phenomenon, I had deferred my proposal to bring these items under the VAT net and announced the continuation of exemption from the levy of VAT on these commodities upto 31st March, 2012.

Revenue generation: Trade suggests how

As Finance Minister Abdul Rahim Rather prepares to draft the budget 2009, he has been interacting with trade and industry chieftains for inputs. Kashmir...

Budget 2011-12: Structural Reforms

Structural reforms are like medical surgery. Such surgical operations have to be carried out only when they become inevitable and they always result into...

The challenges Ahead

We must recognize that the biggest challenge before us is to boost our economic activities to catch up with national growth rate and per...

Some VAT measures

The traders have been confronting a genuine problem of penal action by the authorities for non compliance of rules which were notified much after...

Squeezed Expenditures?

After 2018, Jammu and Kashmir is witnessing a fall in income to the government which is resulting in comparatively low expenditures in asset creation,...