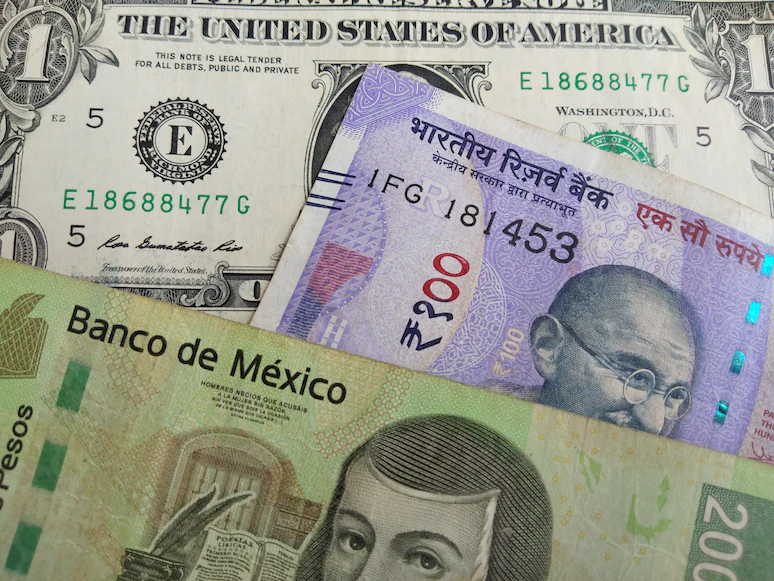

Forex trading is the buying and selling of various currencies with the aim of making a profit. Since it is one of the most prevalent sorts of trading, it attracts a large number of traders from all over the world. One of the key currencies in the foreign exchange market is the Indian rupee, which is one of the currencies of developing economies and one of the principal currencies traded there. In this essay, we will go through the fundamentals of foreign currency trading, with a focus on the Indian rupee and other major currencies.

Learning about the foreign exchange market

The forex trading market is the world’s most significant and largest financial market. Traders may buy and sell currencies from all around the world on this market, which is open 24 hours a day, five days a week. The market is decentralised, which means that it does not function in a single place. Instead, the transaction is carried out digitally via a consortium of financial institutions that includes banks, brokers, and others.

Trading foreign exchange (forex) is a very active and fast-paced market that is open five days a week, 24 hours a day. This implies that traders may have access to the market at any time of day and from any location on the globe in order to trade currencies. The scale and liquidity of the foreign exchange market make it one of the most actively traded markets in the world, with a daily turnover of more than $5 trillion. Due to the fact that this market’s liquidity enables traders to join and exit positions rapidly and at advantageous prices, the market is appealing to traders who are looking for chances to engage in short-term trading. Traders nonetheless need to maintain a constant awareness of the latest economic and geopolitical news and events, particularly those that have the potential to influence currency markets.

Forex trading using the Indian rupee

The use of the Indian rupee in foreign currency dealing is becoming more popular among dealers worldwide. The Indian rupee is the country’s major currency, and it often trades on the foreign exchange market. There are many techniques to follow when trading foreign currencies using the Indian rupee.

Trading foreign exchange using the Indian rupee is possible using the currency pair USD/INR. The most prevalent and popular currency combination in India is the trade of US dollars for Indian rupees. It entails buying and selling one currency in exchange for another. Another way to trade foreign currency with the Indian rupee is to use the currency pair EUR/INR. Particularly, this covers acquiring and selling the euro in exchange for Indian rupees.

To trade foreign exchange using the Indian rupee, traders must first grasp the factors that determine the currency’s value. These components include the nation’s economic performance, government stability, interest rates, and trade balance. Traders must also keep a careful eye on global events such as geopolitical tensions, economic data releases, and changes in monetary policy since these may all have an impact on the value of the Indian rupee.

Foreign exchange trade with the major currencies

In addition to the Indian rupee, a number of other prominent currencies are traded on the foreign exchange market. These currencies include the US dollar, the euro, the Japanese yen, the British pound, the Swiss franc, the Canadian dollar, and the Australian dollar. Foreign exchange, often known as forex trading, is the act of buying one currency with another in order to make a profit.

To trade forex with other currencies, forex traders must grasp the elements that influence the pricing of other major currencies. These components include the nation’s economic performance, government stability, interest rates, and trade balance. Traders must also keep a careful eye on global events such as geopolitical tensions, economic data releases, and monetary policy changes since all of these factors have the ability to affect the value of these currencies.

Methods for trading in the foreign exchange market

Investors may use a range of trading strategies while trading foreign currency (forex). This category includes strategies such as scalping, day trading, swing trading, and position trading.

Scalping is a trading strategy that tries to produce a series of small profits from a high number of transactions made throughout the day. This strategy requires outstanding analytical ability, lightning-fast reflexes, and quick decision-making.

The activity of buying and selling a currency pair on the same trading day is known as day trading. Traders must have a high degree of self-discipline and attention to be effective with this strategy. This is because they will need to make quick decisions in order to profit from short-term price swings.

Swing trading is a trading strategy that involves holding positions for a prolonged length of time, which may range from several days to a few weeks. Since they must wait for market changes before taking action, traders must be patient and disciplined if they are to succeed with this strategy.

Position trading is a trading approach that requires holding positions for a long period of time, which might be months or even years. To be successful with this strategy, traders must have a long-term perspective and a thorough understanding of the fundamental dynamics that drive currency values.

The procedure for choosing a forex broker

Choosing the finest forex broker to deal with is critical for successful forex trading. A reputable foreign exchange broker will be licensed and regulated by a reputable financial body. They will also offer fair spreads and costs, an easy-to-use trading interface, and excellent customer support.

Before making a selection, traders should consider the broker’s track record and reputation in the industry. Visitors may check ratings and reviews on the website, as well as ask for recommendations from other businesses. Another critical stage in the process is comparing the features and services provided by different brokers, such as trading instruments, leverage, deposit and withdrawal methods, and educational materials.

Conclusion

Forex trading with the Indian rupee and other major currencies may be a successful and thrilling experience for traders with the right knowledge, talents, and temperament to engage in the market. Traders must have a fundamental grasp of the foreign exchange market, a robust trading strategy, a reputable broker, and an acceptable risk management plan. Traders that follow these principles continue to educate themselves and stay adaptable in the face of continuously changing market conditions may find success in foreign currency trading.