Nostalgic aroma

As Café Coffee Day’s entry in Kashmir brews up the competition with the few existing outlets, Shazia Yousuf traces the history of the coffee...

Hope at last

With broken marriages, children out of schools and penury, the ill-fated CONFED employees lost everything including esteem. Many attempted suicide, some lost their mental...

Flowery Success

She left a secure government job to wade into unknown waters only to open up career vistas for many in Kashmir. Ibrahim Wani reports

When...

Insured growth

The entry of private life insurance companies has boosted the growth in this sector. Haroon Mirani reports.

The life insurance sector in Kashmir has been...

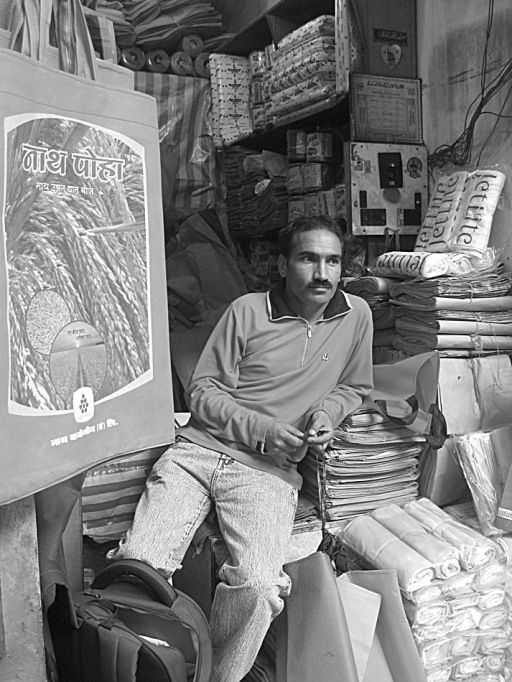

Aspiring Asparagus

A highly nutritious vegetable that grows in Kashmir and has huge demand in the West. Owing to government apathy, asparagus is on the verge...

A Dutch man in Kashmir

A Dutch man is living in Kashmir for five years, making and selling Dutch cheese. Hamidullah Dar meets Chris Zandee to find out what...

Unrealised dreams

Kashmir has often seen slogans for self reliance, both recently as well as in the past. But the slogans have never moved beyond a dream...

A Lost Mat

Paltry returns and social stigma attached to waguv weaving is killing the trade fast. Kashmir is on the verge of losing an indigenous skill,...

Resolute in Aim

Disappointed over the lack of Chip Design sector in Kashmir, electronics engineer Kashif Khan has embarked on himself to change the status quo. Ibrahim...

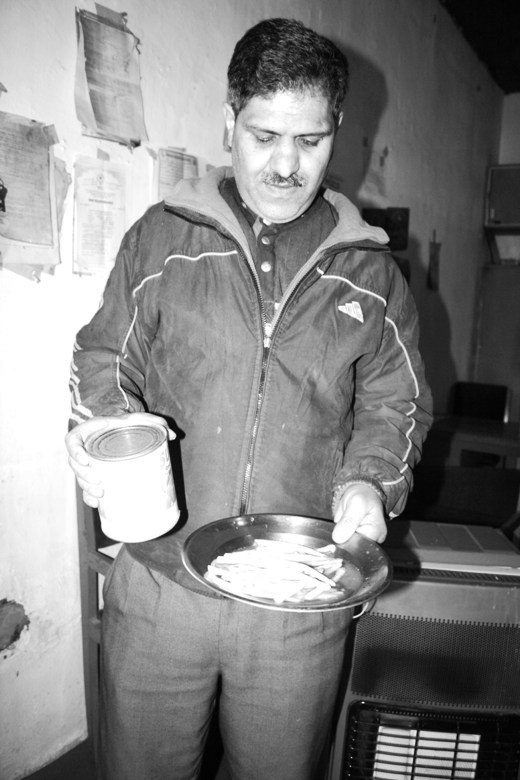

Bartering of a year

Started in a hurry, the trans-LoC trade had more hurdles than pedals. Despite government promises of sorting out modalities soon, a year after the...

A chick and egg tale

His efforts to make valley self sufficient in poultry are not new. Since 1978 when Nazir Ahmad Tramboo’s tryst with the egg started, he...

Public carrier, private woes

For SRTC it has been a journey from riches to rags. The state’s prime mover of men and material has been accumulating losses for...

A lease of life

An integrated cold chain storage facility inaugurated last week has taken Kashmir’s cumulative CAS capacity to 13800-mts with the avowed objective of giving a...

Happy Harvest

Satellite fruit markets (mandis) established in different districts are helping fruit growers get value for their produce at their doorsteps. Some infrastructural lacunae and...

A bag full of business

The ban on polythene carry bags has given fillip to sales of alternatives like paper bags, most of which are prepared locally. Majid Maqbool...