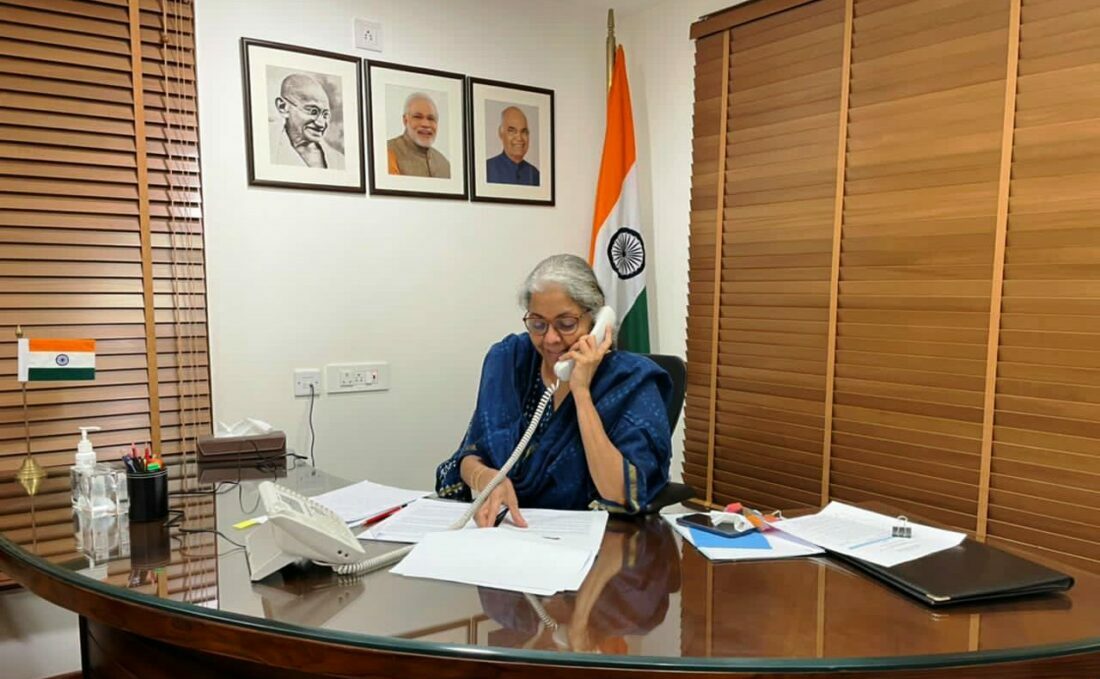

SRINAGAR: Finance Minister Nirmala Sitharaman, in her interim Budget presentation on Thursday, maintained the existing income tax slabs for the fiscal year 2024-25. She also announced a significant withdrawal of outstanding direct tax demands, offering financial respite to a large segment of taxpayers, reports appearing in the media said.

The Finance Minister declared that there would be no changes to the current direct and indirect tax rates, including import duties.

However, she acknowledged the burden imposed by unresolved direct tax demands, some dating back to 1962. Sitharaman proposed the withdrawal of outstanding direct tax demands up to Rs 25,000 for the period up to the financial year 2009-10 and up to Rs 10,000 for the financial years 2010-11 to 2014-15. This move is expected to benefit approximately a crore taxpayers.

During her budget speech, Sitharaman provided clarity on the government’s approach to income tax slabs. She reminded taxpayers that the new tax regime introduced in the previous year’s budget would be the default, but individuals could still opt for the old one. To further ease the tax burden, she proposed an increase in the rebate limit from Rs 5 lakh to Rs 7 lakh in the new tax regime. This adjustment ensures that individuals earning up to Rs 7 lakh annually will be exempt from paying any tax.

The Finance Minister’s focus on tax slabs comes amid ongoing efforts to streamline the taxation process and provide relief to honest taxpayers. Sitharaman highlighted the success of recent measures, citing a drastic reduction in the average time for processing income tax returns from 93 days in 2013-2014 to just 10 days in the last fiscal year.

While maintaining the status quo on most tax-related matters, Sitharaman did make exceptions for startups and investments by sovereign wealth or pension funds. She proposed an extension of tax exemptions on certain income of International Financial Services Centre (IFSC) units, previously set to expire on March 31, 2024, now extended to March 31, 2025.

As the Budget session of Parliament continues until February 9, taxpayers await further details and clarifications on the intricacies of the interim Budget, particularly regarding income tax slabs and the broader implications for their financial well-being.

Defence continues to get the most of the allocations at Rs 622 lakh crore, followed by Rs 2.78 lakh crore to Ministry of Road Transport and Highways; Railways got Rs 2.55 lakh crore; Ministry of Consumer Affairs Rs 2.13 lakh crore; Ministry of Home Affairs Rs 2.03 lakh crore; Ministry of Rural Development Rs 1.77 lakh crore; Ministry of Chemicals and Fertilizers Rs 1.68 lakh crore; Ministry of Communications Rs 1.37 lakh crore; and Agriculture Ministry Rs 1.27 lakh crore.