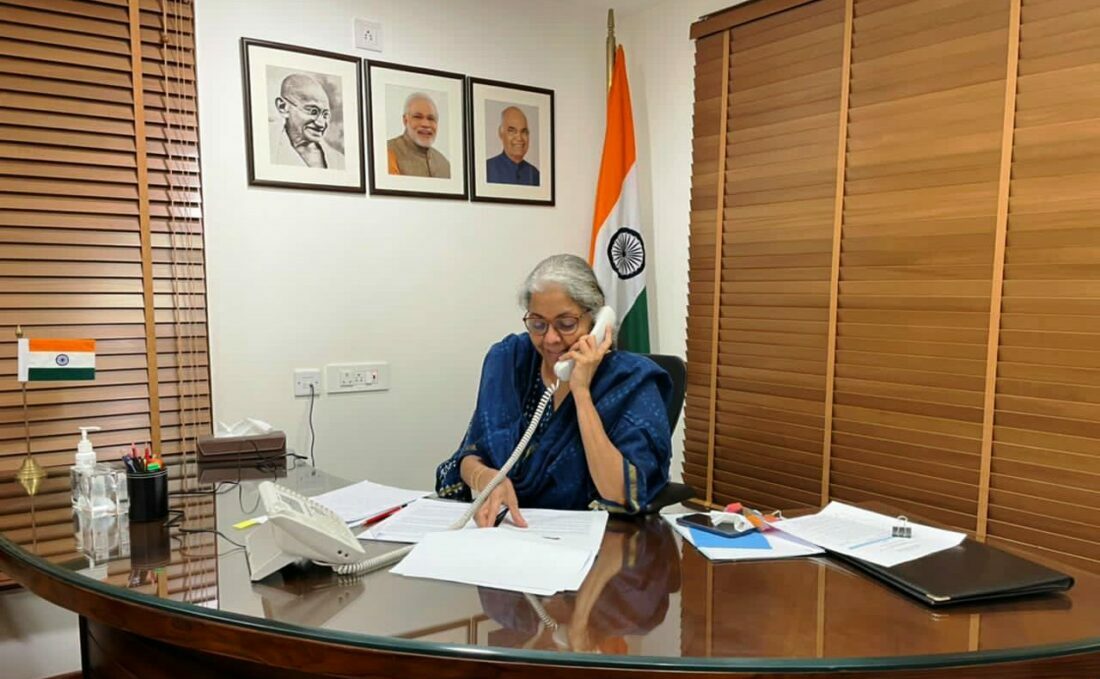

In the third consecutive budget that Finance Minister Nirmala Sitharaman presented in the Lok Sabha, the numbers are seemingly surging but details lack clarity, reports Masood Hussain

Finance Minister Nirmala Sitharaman’s third consecutive budget on Jammu and Kashmir coincided with the Periodic Labour Force Survey April-June 2021 report revealing 46.3 per cent joblessness in the 15-29 age group. In the case of women, it put the percentage at 67.3 per cent.

Fiscal 2021-22

She might have this on her mind but she talked about formal jobs that the government provided and not the situation that encourages markets to create jobs. In the last one and a half years, she said, 11,000 appointments were made in the government and 1,850 in JK Bank “in various government departments in a fair and transparent manner”. While 137870 youth were assisted in their entrepreneurial ventures, the government has identified 20,323 posts in the government for recruitment.

More than one-third of the budget speech revolved around the “historic transformative changes” in the post-Article 370 era. These included the creation of the Panchayat-DDC chain that got and consumed Rs 1584.25 crore while managing Rs 1727.5 crore of MGNREGA and Rs 1455.62 crore of ICDS and Midday Meal schemes. She said under PMDP, an expenditure of Rs 36112 crore was booked. For the first time, 3200 km new roads were laid; international flights were started and cargo facilities were started at the airports. In the power sector, five projects with an installed capacity of 4134 MW worth Rs 34882 crore were taken up by NHPC.

On industrial development, the minister said 4,226 investment proposals worth Rs 47,441 crore stand received. These included proposals worth Rs 18300 crore received during Real Estate Summit and proposals worth Rs 3000 crore finalised during Dubai Expo.

Indicating a post-Covid revival, the minister anticipated the growth rate in Jammu and Kashmir by 7.5 per cent. She said all the tax income indicators are up including GST, IGST, stamp duty, and excise duty. She said in the last seven years, Jammu and Kashmir got the highest number of visitors.

During the current fiscal ending March 31, 2022, revised estimates put on table suggest the overall expenditure booked by Jammu and Kashmir was at Rs 102445 crore of which 35208 crore went to capital expenditure, asset creation and interest payments. The statistics presented suggested that the government was unable to achieve its targets – against the estimated resource devolution of Rs 62656 crore from the centre, only Rs 61501 crore could come; against Rs 16276 crore tax collection within Jammu and Kashmir, only Rs 15480 crore could be collected and the first coin is yet to be collected from Rs 10,000 crore, which the last budget said would be the additional resource mobilisation (ARM). Even the non-tax revenue fell to Rs 7942 crore against an anticipated Rs 8209 crore.

Against budget estimates of Rs 39817 crore, the overall capital expenditure under revised estimates suggests only Rs 35208 crore would be spent. Improving capital expenditure has been the core focus of the post-2019 governance.

There was a surge in the loans, however. The budget had anticipated raising Rs 11480 crore but ended up raising Rs 17522 crore. The huge jump has been in market borrowings that doubled from an estimate of Rs 7614 crore to Rs 15138 core.

Fiscal 2022-23

Anticipated an expenditure of Rs 1,12,950 crore, the budget puts a developmental expenditure at Rs 41,335 crore. The government anticipates an income of Rs 1,02,322 crore. The minister said the committed expenditure stands at Rs 71,615 crore.

On the income side, Rs 68206 crore (34 per cent) will come from the centre as grants, Rs 10600 crore is the GST, Rs 1800 crore is the Sales Tax, Rs 1905 crore is excise duty and another Rs 2361 crore will come from other taxable sources. The non-tax incomes have been estimated to be Rs 8648 crore of which Rs 5000 crore is expected to be the power tariff. The budget suggested Jammu and Kashmir will have additional resource mobilisation of Rs 5802 crore the net fiscal. For the first time, the government says it will raise Rs 3000 crore by asset monetisation.

In the whopping expenditure, Rs 32495 crore (29 per cent of the overall expenditure) would go to salaries, Rs 9780 crore (9 per cent) will be spent on pensions, Rs 7427 crore (6 per cent) on interest payment on debts, Rs 5000 crore on power purchases, Rs 4287 crore on the grant in aid, Rs 3319 crore to central sponsored schemes, Rs 861 crore on maintenance and repairs and other things; and Rs 8446 crore fall on “other” expenditure.

Besides, from the capital expenditure, Rs 17761 crore (37 per cent) has been set aside as the main development budget, Rs 3521 crore as repayment of the debt, Rs 18431 crore under central sponsored schemes, Rs 109 crore for extending loans and advances, Rs 200 crore for equity and investment and Rs 1313 crore for Panchayat Raj Institutions.

Response

Lt Governor, Manoj Sinha thanked Prime Minister “for fulfilling the needs and aspirations of the people” of Jammu and Kashmir and gave a budget that “will ensure equitable, sustainable, inclusive growth and more jobs.” The Rs 1,12,950 crore budget, he said, will provide relief to all sections of the society, especially the common man. He highlighted the allocations across the sector that will help Jammu and Kashmir improve its key infrastructure at the ground level.

Since the budget proposals were made in the parliament, there was an expectation that the three Kashmir MPs – all from National Conference, would participate in the debate. A statement issued in Srinagar said the party members said the Sitharaman budget “ignored the established parliamentary norms and the aspirations of all the concerned stakeholders”. He said a 15-million population should ideally have their own house where they could present a budget but sweeping changes in 2019 created a situation that witnessed 500 encounters. “These figures don’t conform to the peace claims of Government of India,” he said, insisting the normalcy narrative were fake. He claimed nearly 73 per cent of the budget stands earmarked for the Home department only and 61000 daily-rated and casual workers were missing in the document.

Four Questions

It was only in Rajya Sabha where Congress leader, Jairam Ramesh made a brief speech seeking responses to four questions beyond the “politics” of the budget. He said that an impressive expenditure estimate is backed by an income of more than one lakh crore rupees part of which is coming from the sale of state PSUs. “Given the status of PSUs, most of which are either sick or in red,” Jairam asked, “how is the finance minister confidant of generating enough of resources by selling sick companies in Jammu and Kashmir.” The administration has already decided to do away with JK Cements after years of attempting to revive it.

Jairam asked about the details of ways and means that will help Jammu and Kashmir improve its income by additional resource mobilisation – by way of taxes or non-taxes. He wondered if the lifting of more loans from the central government are being seen as a way-out? Against an estimated ARM of Rs 10,000 crore, Jammu and Kashmir government in the current fiscal has not been able to mobilise anything.

The third question that Jairam sought the answer for was how the Jammu and Kashmir administration will manage the doubling of GST in fiscal 2022-23, which though impressive is unprecedented.

Insisting that the Jammu and Kashmir Industrial Development Corporation (JKIDC) is actually a land bank with enormous powers, Jairam said it has made Jammu and Kashmir the only place in India where the land market is completely liberalised. This, he said, is being done to improve investment but wanted to know how many of the MoUs signed already have been translated into projects.

On March 23, Sitharaman responded to the debate saying the people in Jammu and Kashmir are benefiting after the implementation of 890 central laws. People, who earlier lacked rights, can now get government jobs, and purchase properties, she said, insisting 250 “unjust and discriminatory” state laws were removed, and 137 modified.