Beyond the lockdown losses, the constitutional and legislative changes will have a long term impact on the local economy and its structure writes Haseeb A Drabu

Interestingly, the very first indication that the Government of India has set the ball rolling to abjure the special constitutional position of Jammu and Kashmir came from an economic policy decision. On April 18, 2019, the Ministry of Home Affairs announced the suspension of cross-LoC trade between the two parts of Kashmir. “These measures”, I wrote then, “need to be seen in the context of concerted efforts to rescind Article 35A and abrogate Article 370” (My Way or The Highway, May 16, 2019, Greater Kashmir).

The closing down of the trade route was a tangential assault on the constitutional special status. Jammu and Kashmir was the only state that had a local trade route with a neighbouring country. All other border states have international trade routes. Not just that, this road and route was accessible only to the “state subjects”; a category that BJP saw as a privilege as well as a differentiator and has been wanting to obliterate it. They started by nibbling the sides.

Economic Implications

While the political fallout of the August 5, 2019 actions have been now discussed in some detail, if not depth, the same cannot be said about the economic implications of the legislative changes made that day and since then. The political act of abrogating Article 370 has to be understood in the framework of political economy.

There are three levels at which the economic impact of the legislative change needs to be studied. Firstly, the direct impact of a physical lockdown which accompanied the constitutional changes. The financial losses incurred during this period were akin to any other lockdown. The most widely referred to loss assessment in this regard – perhaps the only one in the public domain — has been done by the Kashmir Chamber of Commerce and Industry (KCCI). They estimate the losses to be Rs 17,500 crore.

A 2016 Assessment

Earlier, in 2016, for the first time in 30 years, the state government estimated the losses due to hartals and lockdowns. In the Economic Survey of Jammu and Kashmir, 2016, the normative income loss (between July 8 and November 30, 2016) was estimated to be Rs 16,000 crore. Admittedly a ballpark number.

The income loss assessment was based on annualised state domestic product, the total working days, and the number of lockdown days (originally proposed by the World Bank in 2001). It was adapted to the local situation by taking into account two more aspects; spatiality (geography of the shutdown) and seasonality (pattern of income generation in the local economy).

Using the same methodology, the losses in the post-August 2019-pre-pandemic period would be in the around range Rs 22,000 crore. Add to this the pandemic lockdown from March 24, 2020, till date and the income loss assessment from August 2019 to August 2020 is upwards of Rs 55,000 crore.

It is important to note that the impact of the pandemic lockdown is much greater than the earlier lockdowns that Kashmir has seen and Kashmiris have endured. The main difference from an economic point of view being that the earlier shutdowns were localised; the pandemic lockdown is a national, indeed, a global one.

During the localised shutdowns, the production activity continues, even as the trade and transactional activity gets curtailed. Quite a bit of the output of the economy – especially from the household enterprises, horticulture and the artisanal sectors – is produced. The income generation takes place from sales outside the state; in the rest of the country and also in some cases to the rest of the world. Added to this, the non-resident Kashmiri inflows in the form of remittances also continue.

With the pandemic, even this anaemic economic cycle has got disrupted. Even if goods continue to be produced in the Valley, their value cannot be realised in the market.

Supply Chain Implications

As if this wasn’t enough shock to the economic the system, the manner in which the August-January lockdown was enforced on the ground, it has seriously impaired the existing business supply-chain networks.

Given the structure of the Kashmir economy – import-dependent, export-oriented with a very large informal production base– the impact of this will be significant and serious. More than the loss of income, the snapping of the business networks will hurt more in the medium term.

This, the second level of the economic impact of the August 5 package, has had a debilitating impact trade which is the precursor of trust, of bonds of livelihood and shared prosperity. The horticulturists of Shopian and the commissioning agents of Azadpur have for decades shared good times and survived bad times together.

These have proved to be the strongest linkages between the valley and the rest of the country. This chain is now getting affected. It will not only make the valley even more insular, economically but will isolate it politically as well.

With the NIA nibbling at the heels of trade and business in the valley, scrutinising their transactions and accounts, it potentially opens up their business partners in the rest of the country to questioning. No one would want to trade with them anymore for the fear of transactional enquiry.

Already traders have seen their working capital limits coming under stress as their dealers and suppliers want full advance payment before they supply the goods. Earlier these would be delivered on credit; on trust.

The net result: businesses have assets that they can’t sweat because of demand disruptions; they can’t leverage them because of credit limits are under stress. Their inventories can neither be liquidated nor monetised. They have goods that can’t be transported. They have products that can’t be stored. In all this, a lot of money has got locked in, resulting in a liquidity crunch in business.

Of course, the production costs of all trading and manufacturing activities has increased due to interrupted transportation and regulatory risks associated with it trading in Kashmir. Consequently, their margins have been all but wiped out.

To address and mitigate these emerging issues, through economic policy interventions, will require a regional input-output or a social accounting matrix. This will give us an idea of the “out-of-steady-state” dynamics of the Kashmir economy; what are the inter-related microeconomic decisions being made in response to exogenous political shock. It looks like all commercial activities – industrial, artisanal, trade or agricultural — will be caught in a low-level equilibrium trap. The economy will regress.

Anticipated Structural Changes

Finally, the third level and perhaps the most important one from a long term perspective is the structural changes in the economy as a consequence of the changes in the legislative framework of doing business in Kashmir.

The legislative changes that have been made will have an impact on the structural characteristics of the Kashmir economy as well as the society.

Kashmir, apart from being a political unit with geostrategic importance, is also a self-sustaining economy despite a fiscally fragile local government. It is a supplementary market, not as small as we tend to think, for the goods and services produced in the rest of the country.

Assuming a conservative savings rate of 20 per cent (i.e savings as a percentage of state income, the national average is 30 per cent), the market size of the state is Rs 1.2 lakh crore. This is the consumption of both final and intermediate goods. Conservatively, the final consumption expenditure alone will be in the range of Rs 80,000 to Rs 1,00,00 crore. With an import intensity of 0.60, we are looking at imports from neighbouring states of around Rs 4,000 crore per month.

A $22 Bn Income

The total income that the Jammu and Kashmir economy generated in 2019 was around Rs 1.58 lakh crore. This is 0.85 per cent of the national income. In US dollar terms, the state domestic product, estimated on income originating basis, is the US $ 22 billion making Jammu and Kashmir equivalent to Estonia, a republic in Northern Europe.

All this economic activity is not carried out by the government or for the government. It is not fuelled by the grants-in-aid from the Union government. Instead, it is driven by the investment made over the last 50 years by the local bourgeoisie. Of course, their margins were padded by the fiscal incentives provided by the state and union government.

Indeed, that is an important reason for the local businesses investments that have been made. The earlier legislative framework offered a “regulated” environment for local businesses. I use the word “regulated” because if one looks at it in terms of economic markets, there was no “protection”.

Of the two markets, the foundations of economic development – the factor market and the product markets – there were no legislative barriers except for one segment of the factor market – the land, that too only for non-productive purposes. For industrial and commercial purposes, the land has always been available for the industry since inception with the State Subject Notification of 1927 having provided for it on Clause IV.

Apart from the markets, two key factors of production – labour and capital – were also completely unrestricted and open. The opening-up of the labour market was a natural consequence of economic growth, such as it might have been. So were the money market, and the credit markets; not just open but also completely integrated without any protections.

The Bourgeoisie

This legislative framework has over the last seventy years has helped create a petty bourgeoisie class-divided primarily into three groups: small landowners, self-employed in agriculture or horticulture, and owners of either crafts and artisanal workshops or commercial trade enterprises. They are the backbone of the social economy of Kashmir. The industrialist class is nascent. There is a robust social elite, which doesn’t necessarily overlap with it.

The nascent industrialist class had started investing financial and emotional equity in Jammu and Kashmir. It was being driven by a bunch of young professionals, entrepreneurs. They invested locally to take the business to the next level. They were getting corporatized, leveraging assets, and building partnership. They worked and delivered under hostile conditions, both on the file and in the field.

This could have given the economy a long term direction. But this progression will now face the competition of such size and scale that they are not ready for just yet. They have just about started asserting in the northern region industrial chambers and associations.

The local capitalist class is still into what Karl Marx called “primitive accumulation”; making the extra bucks from subsidies, reservations, quotas and arbitrage. They will now be faced with market forces that result in what Marxists call “accumulation by dispossession”. While in other state economies it has been triggered by globalisation, privatization and liberalisation, in Kashmir it will be triggered by the legislative changes.

Emerging Comprador Class

This will result in a series of sequential changes down the line; a shift from self-employed to wage labour is the most obvious one. Not out of any state coercion but out of market compulsion. It will come across as a rational decision – the Kashmiri farmer will choose wage work because of a higher wage. In the process, he will get alienated, if not expropriated, from his land. The small, medium and micro enterprises will also face a similar fate.

The business fraternity in the valley that emerged in a regulated quasi-protected economy will have to reinvent itself if it has to survive. For them, the partner of yesteryears will now become a competitor, if not an adversary.

Associated with these, will be a change in the social structure of the valley. The owners of relatively sizable trade and commerce enterprises, will either become or be replaced by the “rentier capitalists” class. In many cases, the nascent industrial class will partner with India Inc. How this gets done, will depend on the policies of the government.

These business relationships — of a grower and his commission agent, a distributor and his supplier in Delhi, a crafts boutique owner and his customers in Mumbai – helped reduce the conflictive and the contentious political relationship between the Valley and rest of India. This was the social construct that underlay the political and constitutional relationship.

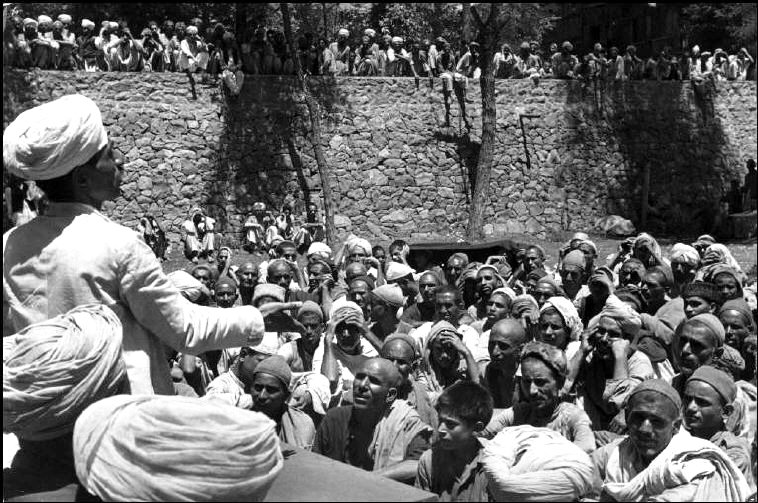

Indeed, it was through this route, more than the central grants, that their interests of the two got aligned. It built a stake for them in the continued relationship with India. This was a big constituency for peace and against separatist. Often they, the local business class, would risk engaging the separatist leadership, at the risk of being labelled “comprador bourgeoisie”, to end prolonged civil curfews and bandhs enforced through diktat. Now under pressure from market forces, this tenuous relationship will also undergo a change.