As the regulator’s restructuring plan envisaged multiple riders, post-August 5, data indicates that Kashmir has doubled its impaired assets in less than nine months, mostly in Q2, reports Masood Hussain

The crisis that Jammu and Kashmir landed in after August 5, 2019, is bleeding the economy of the erstwhile state. In comparison to December 2018, the non-performing assets of the banks operating across Jammu and Kashmir have almost doubled by September 2019. This is expected to witness a further slide once the details of the banking operations for December 2019 quarter are public.

The gross NPAs across Jammu and Kashmir (including Ladakh) were at Rs 2673.94 crore in December 2018, making only 4.91 per cent of the Rs 54495.75 crore. These assets have reached Rs 4147.55 crore, which means seven per cent of Rs 59273.41 crore advanced in the Union Territory (excluding Ladakh) is impaired.

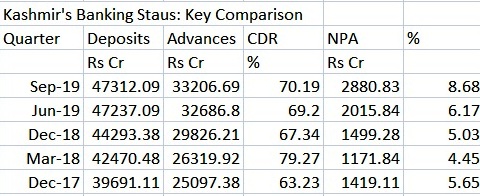

Unlike Jammu region that traditionally has low exposure to credit, Kashmir – the main bread and butter of the banking sector, has bled, literally. From a low NPA of 5.03 per cent in December 2018, the impaired assets have almost doubled and reached 8.68 per cent. Now, almost 70 per cent of the impaired assets of the UT are in Kashmir. In absolute figures, the impaired assets have taken a huge jump from Rs 1499.28 crore in December 2018 to Rs 2880.83 crore in September 2019, in barely nine months. This is being seen as a historic low for an economy that has survived the worst in conflict plagued by frequent unrests and crippling weather conditions. The Q3 will add to the mess.

Jammu and Kashmir is used to taking huge stress because of the situation. It happened after the unrests of 2010 and 2016 and after the September 2014 floods as well. Invariably, in all such situations, the banking regulator, the Reserve Bank of India would come with some package that would help the stressed assets revive, function and expand.

Last fall, the banking sector also expected similar treatment. The Jammu and Kashmir administration did throw its weight behind a plan that would help reduce the costs of the crisis. It took a long time to materialise.

Finally, when it came, it did not help the banking sector because of a set of riders. The bailout package was laced with more “ifs and buts” than clear answers.

The first hitch was the exclusion of the large borrowers of the erstwhile state of Jammu and Kashmir. Only small and medium categories of borrowers are eligible.

Earlier packages would rehabilitate the NPA as well as the standard accounts. The new one made it applicable to the accounts that had nothing “overdue as on August 05, 2019”. Bankers ensured that if there was even a penny overdue on the said date, the benefits were not extended. In businesses, more so in Kashmir, the bank accounts are rarely in a state where there is nothing overdue on any date in a year. Nominally, this happens usually at the conclusion of the financial year in which the companies working for the government usually repay the overdue enabling their banks to have a clean year ahead. For businesses, it is utopian.

Regarding the treatment given to the interest accrued in working capital loans, the “conversion period” has been decided to be 12 months from August 2019 to July 2020. The interest for the “conversion period” shall be funded and converted into Funded Interest Term Loan (FITL). Scheduled for repayment from August 2020 in 24 instalments, the FITL would also include the interest applicable on fresh FITL. However, there is no scope for reimbursement of the already serviced interest.

On term loans, the tenure of the loan would be extended by one year as they will be provided moratorium in the payment of instalment for a period maximum of 12 months. The directions which have gone to the operational units suggest that the interest charged on the term loans during the moratorium period will be converted into fresh FITL. This would again have repayment date from August 2020.

The rate of interest for the fresh FITL has been decided to be 9.25 per cent (fixed) with monthly rests.

Though banks have not insisted on the fresh security and have continued with the extension of charge on the existing security and also decided to enhance 10 per cent on the existing limit, but a shadow lingers.

The government, however, has also intervened with their Economic Rehabilitation Programme (ERP). As part ERP, the government has conveyed to contribute one-third of the monthly instalment of the interest payable by the borrowers of all banks operating in the UT of Jammu and Kashmir. The condition to qualify is, first the accounts should be eligible for restructuring and then the borrowers should have actually paid the two-thirds of the instalment of the accrued monthly interest beforehand.

“We expected that the bailout package will help in rehabilitating the accounts that genially took the hit of the continued strike,” one bank manager, who wishes to remain anonymous, said. “But that did not happen because the package had too many riders. Only a fraction of small accounts were benefitted.”

The share of impaired assets is borne by the banks that actually work beyond seeking CASA deposits. By the end of September 2019, 968 branches of various banks had Rs 47312 crore in their vaults as deposits. They had advanced a total of Rs 33206.69 crore in the ten districts of Kashmir, making it one of the best markets for banks with 70.19 per cent of the CD ratio.

Kashmir and Jammu exhibit an interesting pattern. Jammu has more deposits than Kashmir – Rs 73554.11 crore. With Rs 43361.48 crore, Jammu district alone almost equals the total deposit base of Kashmir, thanks to the most of the corporate offices that have shifted their base from Srinagar during the early 1990s. However, banks have taken an exposure of Rs 25601.96 crore in Jammu region, primarily because of the traditional low credit appetite. At 34.81 per cent, Jammu has only half the CD ratio of Kashmir.

Across the UT, the Jammu and Kashmir Bank (JKB) is the key player: of 1995 branches, 782 (39.19%) belong to JKB; of the total credit of Rs 62004.05 crore outstanding in Jammu and Kashmir, a whopping share of Rs 41,465.30 crore (69.95%) is that of JKB.

So JKB has the major share in the impaired assets of Rs 4147.55 crore as on September 2019. Against gross NPA of Rs 118 crore of State Bank of India, Rs 185.10 crore of the Punjab National Bank, Rs 129 crore of Bank of India, Rs 202.68 crore NPA of the ICICI Bank and Rs 650 crore of the regional rural banks and the cooperative banks, JKB alone has an impaired asset base worth Rs 2349 crore, part of which is in Kashmir.

The devil, as they say, is always in the detail. The district-wise analysis tells part of the larger story.

Srinagar that consumes almost one-third of the total Kashmir credit (unlike Jammu that consumes more than half of the entire Jammu region) is bleeding literally. Improving a bit after the 2016 unrest, Srinagar reduced its NPAs from 8.61 per cent to 7.84 per cent by March 2018. Since then it shot up the curve to 11 per cent in June 2019 and now to a staggering 14.15 per cent in September 2019. The Q3 will take it further.

By the end of September 2019, Srinagar district had Rs 12881.36 crore advances of which Rs 1822.09 crore were categorised as gross NPA by the banks.

Baramulla and Anantnag are the two major players after Srinagar district. The north Kashmir Baramulla had an NPA of 6.22 per cent in December 2018. It improved to 4.82 per cent in June 2019 and then shot up to 7.2 per cent in September 2019. The district had Rs 4343.81 crore outstanding when the bankers met last time in September.

South Kashmir has traditionally retained a low-NPA level throughout. Anantnag had an NPA of 1.47 per cent in December 2017, 1.65 per cent in 2018, and 1.69 per cent in June 2019. In September, however, it reached 3.3 per cent, one of the highest. The district recorded an overall outstanding of Rs 3615.46 crore in September of which Rs 119.32 crore has gone apparently bad.

The apple belt comprising Shopian, Kulgam and parts of Pulwama, is indicating the downslide. Shopian, the smallest district in India, has been exhibiting an exceptional trend for a long time: it would require a credit more than its deposits and would top Jammu and Kashmir in CD ratio. Between December 2017 and September 2019, its CD ratio has gone through the roof from 113.64 per cent to 142.09 per cent. It has been a banker’s dream market because of the lowest NPA of 1.91 per cent in 2017. After retaining its default at around two per cent till June 2019, it has now reached 5.64 per cent. Once the apple growers will return with their vouchers from Azadpur later next month, the percentage will go up. For the first time in last two years, the districts deposit base has shrunken to Rs 935 crore indicating stress. Banks had advanced Rs 1328 crore by September.

Kulgam’s NPA has touched 2.86 per cent and that of Pulwama has gone up to 7.53 per cent.

Unlike Kashmir, Jammu has retained its NPA levels, almost unchanged. It indicates that the trade has been able to prevent its capital from getting blocked in Kashmir. Most of the Jammu industry is supplying to Kashmir and all the major CFAs (Commission and forwarding agents) are also Jammu based with the market in Kashmir.

Insiders in the banking sector said that a positive and forward-looking rehabilitation package would have helped the economy to fight the low-confidence that Kashmir market has been exhibiting for a long time, especially after August 5. They see the tensions mounting in the coming days as the low-yield apple bills will add up. How these tensions will manifest in coming days needs a careful watch.