Even though the JK Bank, the key builder of the Jammu and Kashmir economy managed a good profit on basis of its clean balance sheet, capital infusion and the impressive emotional investment of its staff despite adverse working conditions, the overall banking sector performance is not as impressive as it might appear, reports Masood Hussain

The Jammu and Kashmir Bank stock has been an impressive performer lately after many years. After the bank declared its results and pocketed a profit of Rs 432.13 crore in 2020-21 – Rs 315.75 crore of it in the last quarter (January – March 2021) only, its shares were on a bull run. This has been the highest ever profit the bank posted since March 2014.

The stocks performed so extraordinarily on the bourses that they hit the upper circuit apparently because of the information to the stock exchanges that the Jammu and Kashmir government will continue to support the bank. It gave confidence to the investors that almost 20 per cent appreciation took place within 24 hours.

The Jammu and Kashmir government despite playing a lot of politics with the premier financial organisation did not alter one basic thing – to support it. The government infused Rs 500 crore capital to the bank in 2019-20 fiscal and has budgeted another tranche of Rs 500 crore for the current fiscal. This infusion comes at a time when the bank was around the edge where it would have eroded its capital base and would not have been able to lend any more.

Now, the bank is planning to let its staff purchase shares under an employee stock purchase plan (ESPP) on discounted rates to raise Rs 150 crore. Once this happens, the government will release Rs 500 crore. The details of this plan are not yet fully in the public domain.

A Clean Balance Sheet

The results of the bank for the last fiscal also indicate the same concern. There is no denying the fact that part of the profit story owes to the exemplary dedication of its staff despite the pandemic. The bank lost five of its officials to Covid19 and many hundred survived the infection. There are various factors that contributed to better profit, for the first time after March 2014.

“Twice in past was the balance sheet cleaned though it bled the bank,” an insider who analysed the results said. “To be fair with everybody, the age-old style of adhoc advancing was stopped through a systemic intervention that resulted in a reduction in bad assets, costs and eventually less requirement for the provision and eventually led to better saving for profit. This made the balance sheet, clean and strong in fundamentals.” The bank has a provision coverage ratio at an impressive 81.97 per cent. He said the three lockdowns had a “very minimal” impact on the advance portfolio of the bank because the cleaning of the bank had happened earlier to that.

Experts said the fact is that the last fiscal was not a huge growth year for J&K bank at all. The balance sheet suggests that the growth on year on year basis in advances was only three per cent (on pan India basis) though, in Jammu and Kashmir, it is 16 per cent; deposits grew by nine per cent and there was negative growth in interest and income.

The interest subvention of five per cent that the Government of India announced in 2020 got Rs 1000 crore to the bank and it prevented any slippages on account of business accounts. This amount helped a lot of accounts to survive the asset classification norms prescribed by the regulator.

Talking to a TV network, R K Chibber, the Chairman and MD of the bank said that in fiscal 2020, the bank restructured a loan portfolio of Rs 270 crore and in the current financial year, they have restructured Rs 67 crore loans, already.

Not Delinked From Economy

The performance of the Jammu and Kashmir Bank cannot be delinked from the erstwhile state of Jammu and Kashmir because it continues to be the main building block of its economy. The challenges it faced owing to the post-August 5, 2019 situation and two waves of the pandemic were apparently manageable in comparison to the interventions within the bank for narrow political reasons.

Bank’s performance is still the best if the overall performance of the banking sector in 2020-21 is analysed. The fact remains that Jammu and Kashmir cannot be imagined without Jammu and Kashmir Bank and perhaps that is why it, off late, has been politicised.

Credit Appetite Low

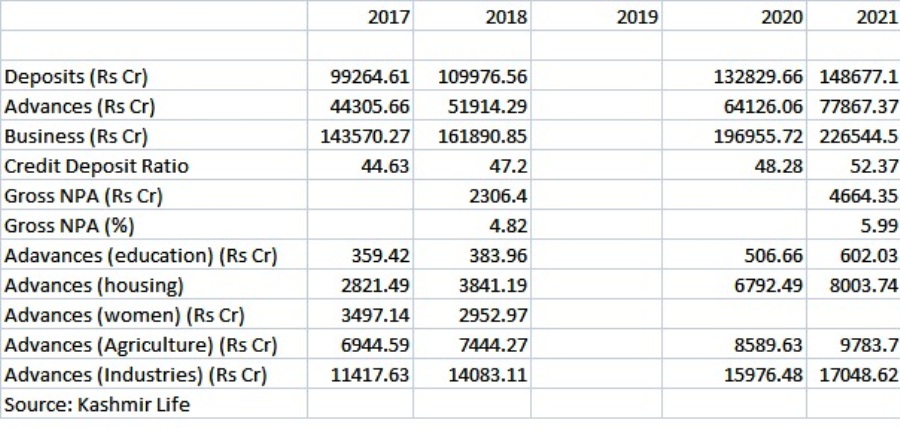

In the last financial year, while the deposits of all the banks grew by Rs 15847 crore to reach Rs 148677 crore, the advances grew by Rs 13141.31 crore to reach Rs 77867.37 crore. Interestingly, Jammu and Kashmir Bank alone has a loan book of Rs 50166.94 crore, which means that it controls 64.42 per cent of the overall loan book in Jammu and Kashmir. Of the advances in the last fiscal, Jammu and Kashmir Bank’s share is more than 49 per cent with Rs 6456.43 crore.

The nationalised banks that service Jammu and Kashmir through a network of 453 branches have cumulatively advanced Rs 5949.29 crore, of which Rs 3422.31 crore was advanced to the corporate sector by the State Bank of India. This means that only Rs 2526.98 crore has gone to the Jammu and Kashmir market directly.

Even though the figures look very impressive, the fact is that there is huge stagnation and Kashmir has taken a huge hit. By the end of March 2018, the Kashmir region had cumulative bad assets of Rs 1171.84 crore, almost 4.54 per cent of the advances. In the Jammu region, the NPA was at Rs 1111.03 crore, which were 5.54 per cent of the advances. Traditionally, the banks earn more in Kashmir because it has a huge credit appetite than Jammu.

By March 2021, the bad assets have gone through the roof. Now Kashmir region has an NPA of Rs 3046.16 crore, which is 7.82 per cent of the cumulative advances of Rs 38938.75 crore. In comparison, Jammu with advances of Rs 31495 crore has an NPA of Rs 1613.42 crore, which is 5.12 per cent of the overall outstanding.

KL Image: Bilal Bahadur

Srinagar and Jammu cities are the two main business hubs. Given their inter-dependence that has evolved over the decades, they both exhibit the same situation – low credit appetite: Srinagar at 51.5 per cent and Jammu at 30.9 per cent. It was almost the same as that of last fiscal. Jammu city, it may be recalled here, has double deposits in comparison to Srinagar city. In fact, Srinagar city’s bad asset percentage is two times that of Jammu.

Underperformance By Banks

The banking sector has underperformed on its own yearly credit plan. It had planned to lend Rs 44630 crore but ended up advancing only Rs 30688 crore (Rs 17329.49 crore in Kashmir and Rs 12533.46 crore in the Jammu region), both in priority and non-priority sectors. Interestingly, Rs 20529 crore of this – 64.78 per cent – was advanced by Jammu and Kashmir Bank alone.

In the last banking sector meeting that the Chief Secretary Dr Arun K Mehta presided over, the banking sector offered interesting reasoning for under-achievement in the last financial year. In the housing sector, one of the happening sectors across Jammu and Kashmir, the banks could advance only Rs 1041.5 crore against a target of Rs 2843 crore. Listing the reasons, the banks said site-plan is a pre-requisite for disbursement of loans. “It usually takes months to obtain NOCs from various departments individually while applying for municipal permissions,” the banking sector put it on record in black and white. It said that the borrowers do not have the pieces of land in their names. “In rural areas and in old towns, mutations of titles have remained pending since (sic) generations and owing to disputes on ownerships, people find it cumbersome to get the extract of revenue records and transfer the land titles,” the documents added. Besides, Kashmir lacks an interest in vertical housing.