In the 2010 summer, the coalition government presided over a new law that made using water for power generation an economic exercise. Apparently aimed at seeking a bit of the fortune that NHPC was making through its operations in J&K, the water usage charge has returned to haunt the state’s wholly owned State Power Development Corporation. The company is unable to get buyers to its generations because the charges have doubled the costs, reports Masood Hussain

After years of celebrating the “punitive” water usage charges on hydroelectric producers in the state, the idea has returned to haunt J&K itself. The Rs 0.80 per unit additional cost that State Water Resources Agency (SWRA) is collecting from the power stations in J&K has reached a level that state’s own power producer State Power Development Corporation (SPDC) has accumulated liabilities of nearly Rs 1000 crore. Interestingly, the charge has added so much of costs to its produce that SPDC is unable to have a buyer for its generations others than the Baglihar-I, for which a power purchase agreement (PPA) was in place in anticipation of State Water Resources & Regulation Authority (SWRRA).

The liabilities on account of Water Usage Charges have accumulated to the tune of Rs 313.93 crore for 2014-15, Rs 332.49 crore for 2015-16 and Rs 420.05 crore for 2016-17. This is in addition to around Rs 0.30 per unit that the SPDC will have to bear on account of wheeling of energy and the transmission losses.

This could hit the idea of the finance minister Dr Haseeb A Drabu who had announced the re-birth of SPDC with a cleaned and cleansed balance sheet with an equity base of nearly Rs 3000 crore in his budget proposals. If the state does not intervene at the highest level to manage its wholly owned company’s liabilities on this account, SPDC has the potential of returning back to the abyss of overload. Additionally, the state being the only buyer of the SPDC energy, the consumers across J&K are consuming the costliest energy in India, right now.

Water Usage charges were initiated in 2010 by the then Water Resources Minister Taj Mohiuddin, apparently in response to a raging public debate that NHPC, India’s hydroelectric giant was exploiting state’s water resources but not offering much in return. The then NC-Congress coalition set up an elaborate mechanism for taking care of the water resources of the state and charging the particular charge. Off late, however, the SWRRA has not done much in its overall mandate as its activities were, by and large, reduced to billing the power generators for using the water resource.

By May 2016, SWRRA did collect Rs 3384.014 crore from NHPC under this head. But the SPDC remained perpetually in default after paying initial Rs 20 crore. Interestingly, the government transferred an amount of Rs 3455.526 crore out of the SWRRA kitty (including interests) to the state coffers. Of this, Rs 100 crore were given to Chenab Valley Power Projects Limited (CVPPL), a JV between NHPC and SPDC holding 49percent each with the balance two percent being shared by PTC, NTPC. CVPPL is mandated to set up three power projects on Chenab basin but is running much behind the schedule.

The story of SPDC getting gradually into a crisis is interesting. Unlike past, every state has a clear mechanism of how tariffs are determined. It is for all, the GenCos – the power generators, TransCos – the transmission utilities and DisComs – the power sellers to the end user. Every time, when the power project gets into commercial generation, the owner approaches the State Electricity Regulatory Commission (SERC) in J&K (and to CERC in case of NHPC) with a detailed petition listing its per unit costs on basis its investment, debts, working capital and other taxes to determine the tariff. Power distributors follow the came course.

SPDC is the second major power producer in the state. It has three types of assets. Firstly, a bunch of small power projects scattered across the state, the ownership of which was transferred to SPDC in 1995, when the SPDC was born. This transfer was made at a nominal cost of Rs 1. In his recent budget speech, Dr Drabu said the re-evaluation of these assets would now cost almost Rs 1000 crore.

Most of these projects are quite old and rundown. Some were up-rated under a new all India scheme. Still most of them are generating very costly energy and some of them are so expensive that SPDC has to invest from its own kitty to keep the show going.

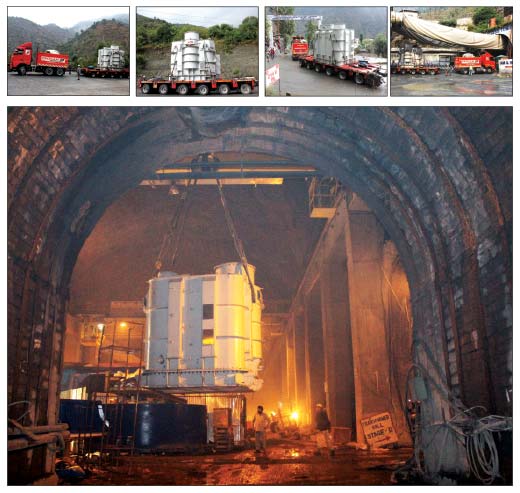

Secondly, 450-MW Baglihar-I, the major asset of the SPDC was commissioned at a time when SWRRA was not in place. It had already inked an agreement with the Power Trading Corporation to take half of the generation for sale to fund debt servicing. Half of the energy from Baglihar-I is being consumed by the PDD at Rs 2.69 per unit as the balance half is evacuated by PTC at Rs 3.65. Revenue realized from PTC funds SPDCs debt servicing.

Thirdly, Baglihar-II of almost equal installed capacity started working only last year. Its techno-economic viability was cleared on basis of a situation where SWRRA was not around. But when it started generations, its output is bound by SWRRA. Since the SERC loaded the entire costs to its tariff, it has reached a level that there is nobody across India who can purchase this energy. As the last resort, it is the state government itself (read PDD) that is evacuating this energy to its grids and supplying to its consumers. That may be quick-fix solution but is not sustainable on long term basis, especially when the energy in open market is available at almost half the cost!

Energy in open market has, off late, witnessed massive fall in the tariffs. The main players in capacity additions are thermal power producers which are using cheap imported coal to generate power that is perhaps the cheapest energy right now. Emphasis on solar and other renewable energy resources have added to the overall energy thus brining solar almost closer to the hydroelectric tariffs in the mainland India.

This past summer SPDC joined Energy Exchange through PTC. Soon, it authorized PTC, to bid on behalf of SPDC in Reverse Auction (an auction by sellers and not buyers) for sale of generations of Bagliahr-II to UPCL, Uttarkhand and CSPDCL Chhatisgarh. It also asked GMRETL to participate on its behalf in the bidding process initiated by PSPCL and UPCL. SPDC firmed up its per unit cost at Rs 4.13 per unit which included water usage charges and the wheeling charges. The basic cost, excluding the additions of taxes and wheeling, was Rs 3 per unit.

Interestingly, all the four bids failed. It could not qualify because SPDC offerings were much higher than the fixed rates of these power utilities: PSPL had fixed rate of Rs 3.60 per unit on round the clock basis, UPCL Rs 3.13 and CSPDCL had its tariffs for different slots at Rs 2.13 to Rs 2.60 for every unit. Any effort to sell power at cheap rates – may be Rs 2 per unit, to bag the contract, would have lead to massive losses to the SPDC and created sort of a scandle. Energy in J&K is at the core of a raging public debate on resource mis-management.

For SPDC the crisis is immediate. From later this quarter, its repayment is starting and so far its credibility in market is because it has not defaulted. On table are various ideas to mange proper sale of its generations. It may have to relook at the power purchase system it had earlier evolved. Instead of selling only 40 percent of generations to non-JKPDD buyers, it may have to offer almost 60 percent for a bulk buyer. For finding a dependable buyer on long term basis, it may have to sell for 12 years instead of 12 and bear the water usage charges at its own level without transferring it to the buyer. NHPC has quietly managed the impact of the water usage charges by passing it to the buyers after taking the award from the CERC. SPDC could have taken the same route but its energy costs are getting so huge that nobody in the market is willing to touch it.

Whichever option the SPDC will avail, it is unlikely that it will get a buyer at this rate. Its friends in the market have suggested it that when its tariffs range between Rs 2.50 to Rs 3per unit, then only can it be able to sell in the changed market conditions.

For the policymakers, the crisis is three-fold. First, how should the SPDC market its generation when its costs are huge if compared to the prevailing market rates. Second, if the state government chooses to purchase the entire generation, it will bleed for two reasons: one, the state is topping the all-India tally on AT&C losses so it will have to get the costliest energy and get nothing in return; two, it will put its consumers at a huge disadvantage if it purchases so costly energy and supplies it at irrational rates. Third, how should state respond to the opening up of the energy sector in which energy coming from cheaper sources is making hydroelectric power expensive? Which policy implications, the open market has for state’s long term energy policy.

It is interesting to mention here that J&K government has already given an exemption from Water Usage Charges to the CVPPL owned 1000-MW Pakal Dul project that is yet to come up. This was done to improve its viability. SPDC owns 49% percent of the CVPPL. Insiders in SPDC said that since the precedence is already there, the government can invoke the same for SPDC owned projects. They said if this is not available to them, then viability of some of the ambitious projects like that of 1800-MW plus Sawlakote would always remain hanging.

But the larger issue is if Pakal Dul and SPDC projects are given this concession, what is the logic for seeking it from NHPC. This is interesting that the NHPC is not paying the water usage charges from its own pocket. Instead, it has passed the cost to the consumer. Policymakers will have to relook and possibly review the ‘energy cosmetics’. The other easier option is to get royalty improved rather than seeking cash.