The situation was a key factor in destabilising the public sector undertakings in Jammu and Kashmir. Some of the PSUs were pulled out of the red and put on a growth trajectory. As the parasites started feasting on opportunities, some of them sank again. Jammu and Kashmir Cements Ltd with huge liabilities is now being sold, reports Masood Hussain

In offing for many years, the Administrative Council (AC), Jammu and Kashmir’s de facto cabinet comprising the Lt Governor, Manoj Sinha, his lone adviser, Rajeev Rai Bhatnagar, and Chief Secretary, Dr Arun K Mehta, finally decided to do away with the JK Cements Limited. For divestment, a process envisaging the disposal of assets in any of a variety of ways, usually for ethical, financial, or political reasons, the erstwhile profit-making company will be e-auctioned.

The wholly government-owned company was one of the score-off PSUs that had a very promising future but went into red – like many others, owing to situations linked to strife and bad governance. Officials said that the decision was dictated by the company’s failure to sustain and manage its finances properly and maintain efficiencies of operations over the period of time. Besides, the company was unable to fully exploit the potential and sustain stiff competition in the market despite having dedicated limestone mining leases at its disposal. The company had assured demand from the government against advance payment but it failed to show requisite growth and generate cash flows and operating margins as its production and revenues witnessed a sharp decline since 2012-13, the officials added.

Over the years, the company is hugely in red on account of unpaid salaries and default in statutory deductions like CP fund and GST. Besides, its borrowings from the market are all unpaid.

The Council had taken the decision on October 19, 2021, that the company needs to be sold to a private company that can revive and run it. The government would adjust all the employees of the company. “The interested bidder should have a minimum net worth of Rs 250 crore, must have a net positive EBITDA in at least three out of the immediately preceding five financial years,” official sources said. “Eligible entities are permitted to form a consortium comprising up to four members, to participate in the transaction.” The acquirer will have full ownership of all the assets and mining leases that the company has.

Post Closure Tragedies

How the process will go ahead remains to be seen. However, what the insiders in the erstwhile company suggest is the requirement of investigating how the company reached to this stage and identifying the people who contributed to the mess that a potential profit maker is now on sale almost as scrap.

While the company is being sold in 2022, there have been dozens of tragedies that the staff of the company witnessed after the operations were closed, their salaries stopped and the staff pushed into a sort of penury. “We had very painful stories, especially about the staffers who had given their lives to the company,” one erstwhile staffer, an engineer, said. “In one case that I know, a gentleman who served for more than two decades retired and had nothing in his pocket and was quickly inflicted by renal failure. His family sold ancestral land for his treatment but he could not survive. I do not know how the family is managing it now. I have not been in touch for a very long time.”

In another case, a family could not manage even the basic costs to fund their father’s brain tumour. The only outcome after his death was that his son dropped out of school.

The company had more than 550 employees on its rolls in its Srinagar operations and another 80 in Jammu where it had started a grinding unit. In all these years, as many as 218 staffers retired without any benefit including the provident fund they had earned. As the future looked gloomy for the company, the government put almost 470 employees of the company on deputation to other departments so that they work and get their salaries.

“I have not received my salary for the last 19 months of my career but there are cases in which the salaries are withheld for more than 24 months,” one managerial rank officer said. “CP Fund has not been credited to the staff accounts for 50 months and I am told salary arrears are more than Rs 53 crore now.”

If the divestment is going to make some difference in the lives of this unfortunate lot remains to be seen.

Making of Company

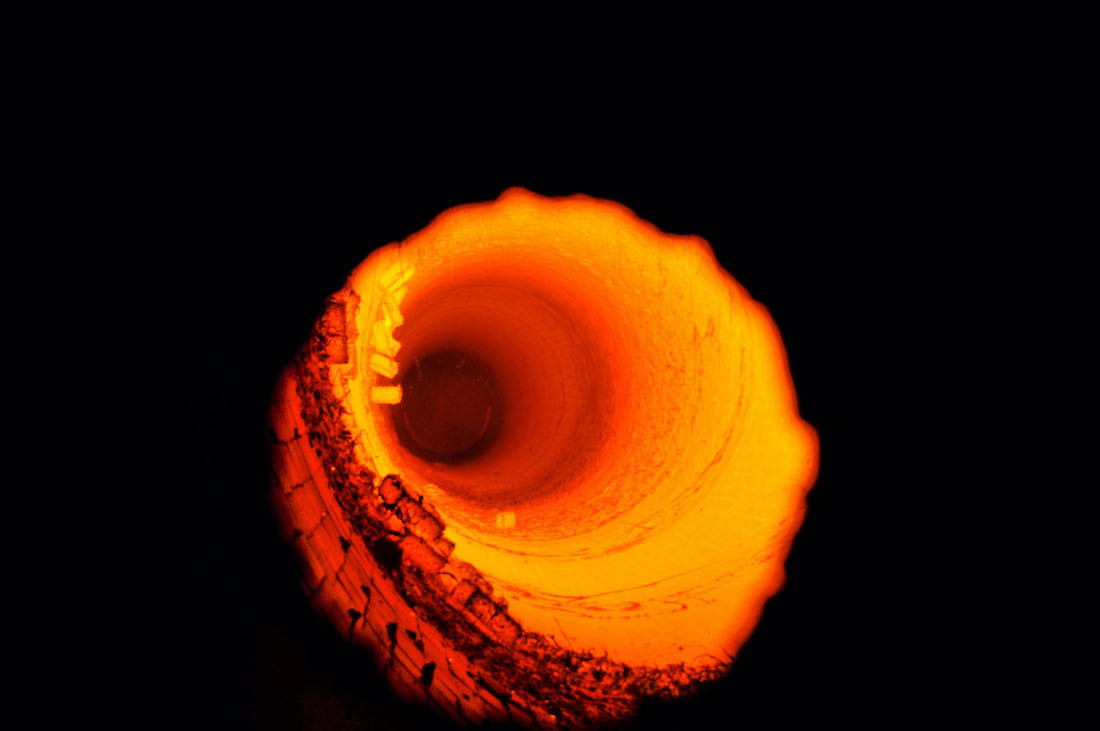

Having rich limestone deposits, the Jammu and Kashmir government incorporated JK Cements as a fully-owned Government Company in 1974. Its plant went into commercial production in 1982 with an installed capacity of 600 metric tonnes per day (tpd).

Fundamental to the incorporation of the company, the government in November 1977 had allotted land measuring 88.10 hectares on lease for 20 years for extraction of limestone having 12.09 million tonnes (proved) and 5.75 million tonnes (probable) reserve of limestone The company, according to CAG had extracted 5.10 million tonnes of limestone till September 2014. The lease deed was renewed up to the year 2007 and thereafter no further renewal was obtained.

Apart from the April 1982’s old plant, the company commissioned a new plant in 2010. The installed capacity of production of cement of each plant was 2 lakh MTs per year – 600 tpd for each facility. However, the company could not manage even 500 tpd from both facilities. Why the plants were under-utilised is the story behind the failure of a good company.

Cement is produced from clinker, which is an intermediary product produced from limestone, clay, iron ore and many other things. Till 1997, JK Cements was producing Pozzolana Portland Cement (PPC) and instead started manufacturing Ordinary Portland Cement (OPC). In October 2007, the company took a decision to move to cheaper and fashionable fly-ash-based PP Cement. It got the licence in 2012 but never produced this cement, CAG pointed out.

Two Major Developments

Insiders said there were two major developments that contributed massively to the undoing of the company before the governance mess started destroying the institution.

The closure of the old plant by the pollution control board in July 2018 was a factor. It has serious issues as the plant was almost forty years old and the technology had changed. “We tried but the spares were not around,” one manager rank officer said. “Then we mooted a proposal of improving the plant and making it better and that would cost Rs 80 crore. It was rejected by the government and then we floated another idea in which we sought only Rs 30 crore so that certain changes are made in the same plant but the bureaucracy did not approve it.”

Anticipating the collapse of the old plant, the company board had already approved the setting up of a new plant. On a turnkey basis, the 600 tpd plant was implemented by Bengaluru-based Promac Engineering Industries. Though it was never handed over to the company, the new plant – supposed to be a modern one, never reached even half of its installed capacity. When the company retained part of the funds, it brought in pressures and managed most of it within the agreement clauses. The company even lacked the courage and capacity to go to court against the project implementer. Many think the bosses were “encouraged” not to move court.

In between, there was another development. The government decided that a grinding unit must be started at Samba. It diverted attention and added to the company’s debt burden.

The new plant cost Rs 87.52 crore and the Samba plant Rs 26.96 crore. Most of it was debt-funded, mostly by JK Bank.

Strife and Strike

The company was hit by a crisis when the working days were seriously impacted by the situation. Of the 17520 working hours available to its manpower for a year, the company lost 4313 hours in 1994-95 in strikes and holidays, which went up to 6374 in the subsequent year. However, after an elected government came into power in 1996, the situation reversed. Against losing almost 43 per cent of the time in 1995, only three per cent time loss was recorded in 1999-2000. As the NC government handed over power to the PDP-Congress government, JKCL was profit-making. It had paid Rs 7.25 crore of Sales Tax and registered over two crore rupees of profit after paying wages to its 680 employees. Completely debt free, it paid a Rs 45 lakh dividend to the government for the first time in 2001-02. It was on this basis that upgradation and expansion were decided.

The fatigue reappeared very soon and most of these issues, a senior officer said, emerged just because of the bad company governance. “JK Cements is a production company and it is supposed to be run by engineers,” the erstwhile officer said. “There was deterioration in the selection of our Managing Directors, who were politically connected but had no idea about how to run the plant and that contributed immensely to the fall of the company. Some of them were experimenting a lot and that brought us to doom.”

The company had shown signs of sickness as early as 2013. In 2011-12, the company reported a profit of Rs 4.35 crore. A year later in 2013-14, it reported a loss of Rs 16.93 crore, which jumped to Rs 26.28 crore in 2014-15. The managers could not get the message. The company, insiders said, was sacrificed by the political executive for the well-being of cash-rich SICOP that was converted into a literal “breeding ground of our MDs”. When the debt liabilities surged, the working capital was exhausted and there was nothing for purchasing the raw material. “The company still owes a lot of money to the companies who supplied the raw material.”

“This all started when Surjit Singh Slathia was the industries minister and the company was doing better,” the officer said. “He gave charge of JKCL to MD SICOP, R K Razdan and once he retired, he was reappointed our MD despite the fact that he knew nothing about what cement manufacturing is all about.” Once he retired, another SICOP man, RL Tickoo was imposed on the company. “His (minister’s) entire focus was to build a 300-tpd grinding unit in Samba before the elections, something that he achieved at Rs 20 crore investment.

Later another NC minister brought in Rakesh Sharma, who was a General Manager at SICOP. “He knew nothing and I remember, he once said we must change the line of activity and get into fisheries instead,” the officer said. “They all negatively contributed because they were serving the ministers who appointed them and not the organisation.” To all these officers, the JKCL union played a supporting role. “How can a union of a factory spare 100 people for industrial activism? They were used as tools by these officers and the ministers and now they are repenting,” the officer added.

Later, Atul Sharma – again from SICOP – took over for some time. The company finally closed when Ishtiyaq Ahmad Drabu was holding the fort.

Cash Cow

JKCL was dependent on two major raw materials –coal for its hearth and clinker for the production of cement. Importing coal from outside has been a major business that the company offered to the market. In its earlier crisis in the 1990s, it was a series of compromises that the management had made in procuring the coal that complemented the crisis triggered by the situation.

When the new plant was “commissioned” at Khrew, the planners thought it would produce enough clinker that will feed both plants. That, however, was not the case. A stage reached when the company had to procure part of the clinker from outside. It became another profitable business for many outside the company. Some of the major cement producers in the plains would supply the clinker.

CAG, which audited the company accounts for 2012-2015, said the failure in managing the shortfall in clinker production proved very dangerous. The shortfall was 5.30 lakh MTs in the new plant, which resulted in a loss of production of cement valuing Rs 388.19 crore.

It would procure per ton clinker at Rs 6500. The company was producing the same at Rs 3500. When the local cement majors heard of the exorbitant rate being offered by the public sector cement maker they offered the same at a much lower cost. The JKCL bosses refused to take it saying it will hurt the company’s reputation in the local market. Due to low production, the company purchased clinker from the open market in 2010-11 and 2012-13 to the extent of 0.38 lakh MTs at a cost of Rs 23.18 crore, when it could have managed it locally at almost half the price.

The company, it can be recalled here, had created an aura about its production quality because it was the preferred supplier to a captive market – the Jammu and Kashmir government. In order to prevent the local cement manufacturers from entering the government business, the company officials would resort to these theatrics of playing down the competitors. It often sold its product at a much higher cost to the government, exploiting exclusive privilege to the captive market. Finally, the private players approached the court, challenged the JKCL’s wisdom and broke the monopoly.

Up for Grabs

The competitors were watching the ship sinking. As early as December 2021, the JKCL was contacted by the Cement Corporation of India offering to take over its Samba operations along with the people on rolls.

Now the company’s liabilities are stated to be somewhere over Rs 300 crore. These include the debts from banks, the salaries of its employees, post-retirement benefits and provident fund. Some of the hunger-stricken employees had gone to court seeking relief. Though a direction was passed by the bench, the implementation could not take place for a lack of resources. The company had Rs 65 crore in fixed deposit and it was utilised to fund some of the liabilities.

For more than three years, the JKCL has been shut. Barring a few watchmen, only pariahs are seen moving around its facilities now. It was just the issuance of an order that would confirm the situation that prevailed in the once-profitable venture.

The big question, now being asked is, what next? With the government ready to take the employees on its staff, who is interested in taking over the company? Are local players interested or the companies that supplied the clinker to it at double the rate will finally have their breakfast at JKCL?